ProRis blue.

A strong foundation. New ideas.

ProRis blue can be used in many ways, by primary insurers for their passive reinsurance, by professional reinsurers for active reinsurance and retrocession business, by reinsurance captives or captive management companies or by reinsurance brokers to manage their business. ProRis blue was designed for a wide range of applications.

ProRis blue Highlights

The ProRis blue system, based on the proven functionalities of ProRis classic, supplemented by web components, supports you in all processes relating to reinsurance. Thanks to intuitive interfaces and improved clarity, you can complete your tasks even faster, which is becoming increasingly important in today's fast-close environment. Less time spent operating, more time for the actual work.

Underwriting Workbench

Life

Manage your life reinsurance business on a per-risk or lump-sum basis. Handle different rates and automate reinsurance settlements.

Maximise with different rates and create your reinsurance settlement automatically.

Become independent.

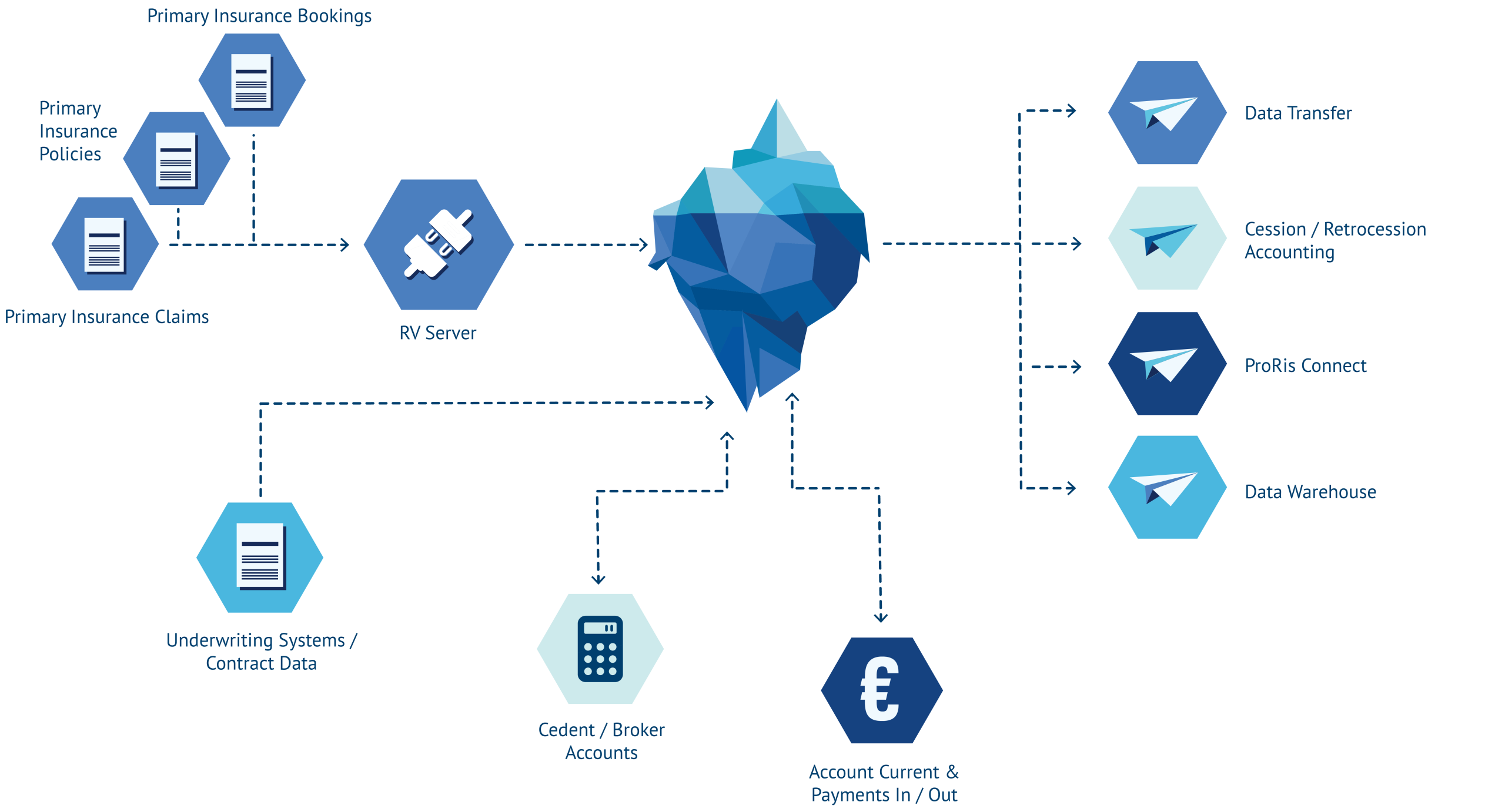

RI Server

Starting with maximisation, the determination of optional requirements and billing, everything is automated.

Sum excesses, catastrophe cover? No problem!

Events

Generate portal-controlled claims notifications for your partners.

IFRS17 / Solvency II

Single risk contract & billing

ProRis in the reinsurance environment.

The processes are supported by the integrated underwriting system or the interface to external systems. Workflows and document generation round off the process. A bidirectional and configurable interface to the financial accounting system is also available.

„Our decision in favour of ProRis was primarily based on our future requirements in terms of efficiency and security as well as regulatory and market flexibility.“

Markus Fricke, Corporate Development VGH Insurance Group Hanover

Core functions

Contracts

Everything is possible. Supports both ceded and assumed business, providing a comprehensive view of your entire portfolio, from contract groups to individual treaties, tailored to your requirements.

Billing

Account Current

Catastrophe Loss

Aggregation of individual losses into a single catastrophe event, automated settlement of catastrophe covers, and customized scenario analysis.

Forecasting Module

Forecasts for up to four years based on actual data, empirical values and individual parameters.

Reports

Integrated analyses and statistics that meet both standard market requirements and your individual needs.

Partner

All partner data accessible at any time within a single module.

Fast Close

Preparation of internal financial statements for any reporting date - monthly, quarterly or annually.

Data exchange

Experience ProRis.

Open ProRis blue webinars

How does the current account module work, what can the Underwriting Workbench do and what do I need to bear in mind when it comes to the RV settlement? In our open webinars, you can learn more about a wide range of topics relating to ProRis.

ProRis User Forum

Once a year, we invite our customers to a user forum where we present the latest developments in ProRis. We always look forward to this personal exchange.

Personalised advice

We are here for you - we stand for customer proximity and customised solutions. If you have any questions, challenges or problems, our customer advisors are always just a phone call away and will provide you with comprehensive advice.

Questions? We look forward to hearing from you.

Torsten Ullrich

Managing Director & Head of Reinsurance

Bertrand Scheller

Managing Director & Sales Reinsurance

Our customers.